In the U.S.’s Most Expensive Cities, 1/3 of Renters Spend More Than 50% of Their Income on Rent

Published: 5/10/22

It’s no secret that the U.S. is in the midst of one of its worst housing affordability crises in decades. According to the New York Times, over the past two years of the pandemic U.S. homeowners have gained more than $6 trillion in wealth while rents continue to skyrocket and inflation eats away at income. We surveyed 1,250 renters across the ten cities in the U.S. with the highest rental prices to see just how much people are spending to live in a major metro area.

Key Points

- 1 33% of renters spend 50% of their income or more on rent

- 2 28% know someone who has been evicted since the eviction moratorium expired, while 12% have been evicted themselves

- 3 29% are regularly late paying rent and 25% are regularly late paying their utilities

- 4 The majority strongly believe government action is needed on affordable housing

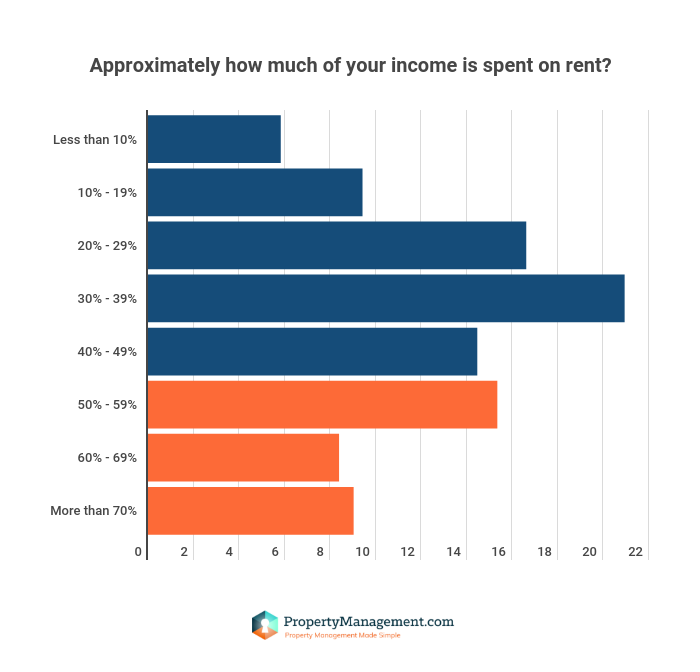

One-Third of Renters Spend 50% or More of Their Income on Rent

According to Zumper’s latest rental report, the U.S. cities with the highest rents are currently New York City, San Francisco, Miami, Boston, San Diego, San Jose, Los Angeles, Washington D.C., Oakland, and Fort Lauderdale. Of the 1,250 renters we surveyed living in these cities, one-third reported spending half or more of their income on rent alone. In fact, 9% of respondents report spending upwards of 70% of their income on rent.

“My rent at a house in the city used to be $1,650, and it was going to skyrocket to $2,000 if we had chosen to live in that house another year,” said Brittany Mendez, a renter in Nashville, Tennessee. “Not only was it going to skyrocket, but the landlords barely took care of the house, but when demand is so high, no one cares about quality.”

“I also took on a few side hustle jobs like photography and freelance writing to cover the majority of the extra expenses. We chose to stay near the city because we both work from out of there and the commute with traffic can be brutal,” she continued.

1 in 5 Who Renewed Lease Say Rent Increased by More Than $200/Month

Renters in these cities aren’t just moving to places they can’t realistically afford. 28% of respondents renewed their lease in the same location they lived last year even though their rent increased. Of this group, one in five say that their rent went up by $200/month or more compared to what they paid for the same space last year.

“My rent went up $300 (13%) in one year, the same amount it had gone up over the previous six years [combined],” said Christy Anderson, a renter in Austin, Texas. “I saw it coming, as reports were that rent was up 30% across the city…I still have to commute to my job [and] the only option is to double my commute and live far from city amenities,” she continued.

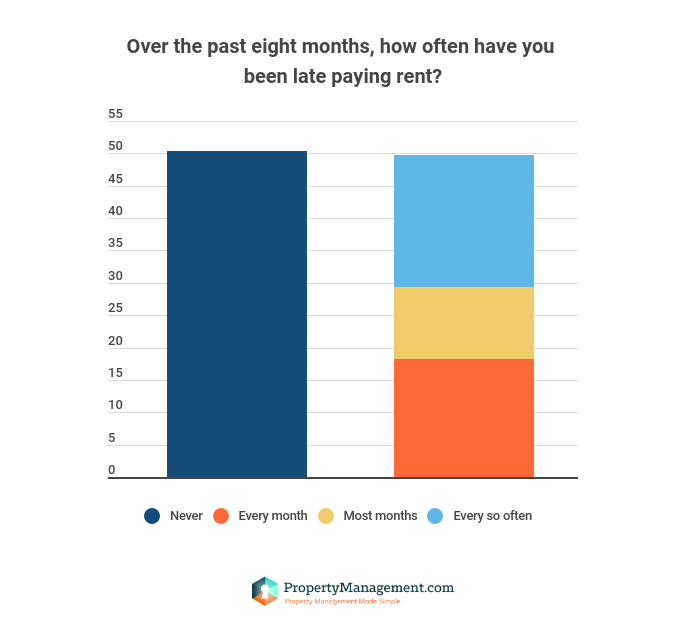

29% of Renters Are Regularly Late Paying Rent

The strain of inflation and rising costs of living is clear when looking at the number of respondents who report paying their bills late. 11% of respondents say they are late paying rent most months, while 18% say they are late paying rent every month. Additionally, 12% of renters say they pay their utility bills late most months and 13% are late paying their utilities every month.

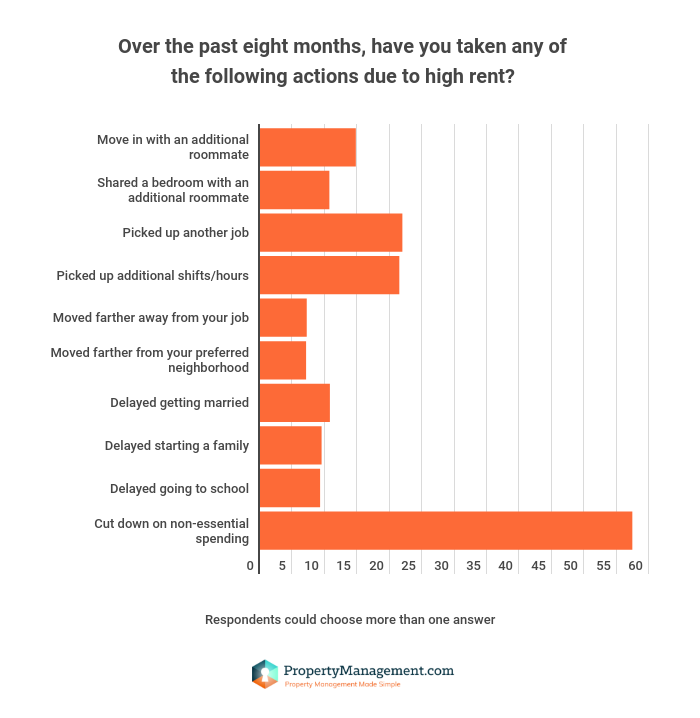

Financial Strain Leading to More Work and Crowded Living

When asked what actions they have taken to accommodate rising rents, 22% of renters say they have picked up another job and/or extra shifts at their current job. 15% say they have moved in with an additional roommate while 11% have shared a bedroom with an additional person. 10% have even put off getting married or having a family, while 57% say they have had to cut back on non-essential spending.

12% Have Been Evicted Since Eviction Moratorium Expired

Since the Supreme Court struck down the pandemic-era eviction moratorium in August 2021, 12% of renters in the U.S.’s most expensive cities say they have been evicted. 28% of respondents say they know someone who has been evicted. Of the 12% who have experienced eviction themselves, 24% say they have been evicted twice over the past eight months while an additional 21% have been evicted three or more times.

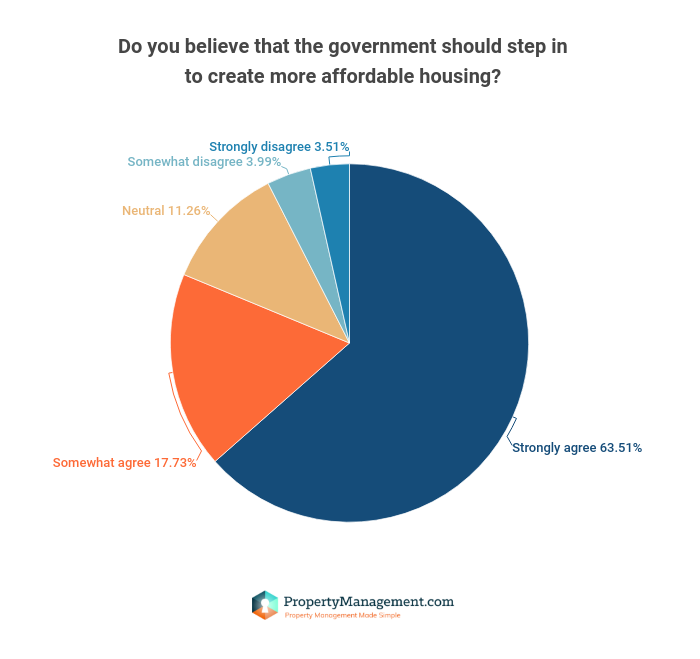

Majority Strongly Believe Government Action is Needed

Unsurprisingly given the financial strain renters have experienced, 81% of respondents somewhat or strongly agree that the government should step in to create more affordable housing options.

“If I had to pay my student loans right now, there is no way I could afford a one-bedroom apartment, “ commented T.J. “Pax” Hardy, MPH, MSW, a renter in Denver, Colorado. “Forget about buying. I can’t save the down payment and I can’t even pay the $455,000 for a fixer-upper.”

“I have two master’s degrees and work in a respectable profession. I am on the verge of needing a roommate just to make ends meet and hope to God I don’t live long enough to retire,” Pax finished bluntly.

30% Have Postponed Plans to Buy a Home in 2022

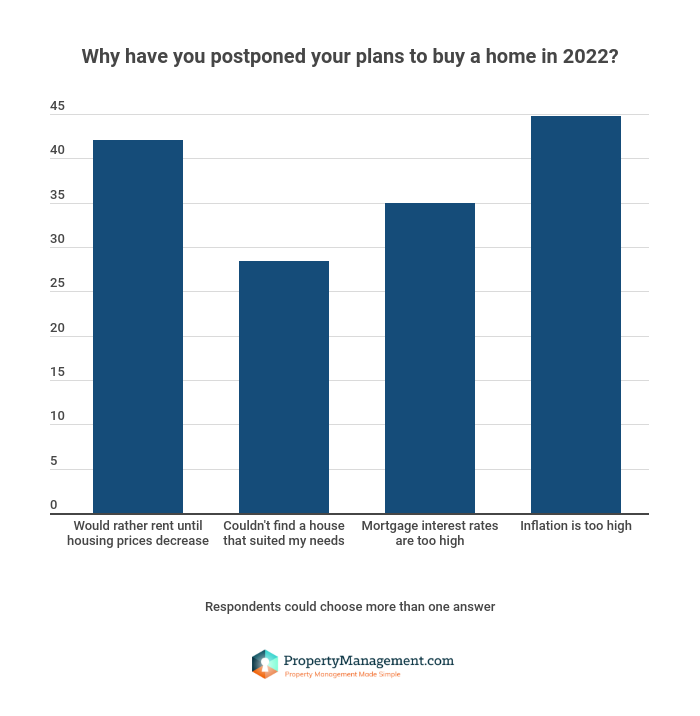

When asked about their plans for buying a home this year, 30% of respondents stated that while they previously had plans for buying a home in 2022, they have decided to postpone. When asked for their reasoning, 45% say that inflation is too high and 42% say they would rather rent until housing prices decrease.

Interestingly enough, 15% of this group has a household income of more than $100,000/year, indicating that the housing market has become so unaffordable that even those with seemingly comfortable incomes are struggling to buy a home.

Methodology

This survey was commissioned by PropertyManagement.com and conducted online by the survey platform Pollfish between April 30 and May 2, 2022. In total, 1,250 participants in the U.S. were surveyed. All participants had to pass through demographic filters to ensure they were 18 years of age or older and resided in one of the ten target cities. The percentage of respondents from each city is as follows:

- 13% from Miami

- 3% from Fort Lauderdale

- 27% from New York City

- 4% from San Jose

- 2% from Oakland

- 6% from Boston

- 6% from San Diego

- 6% from San Francisco

- 6% from Washington D.C.

- 26% from Los Angeles